Organic silicon sources have high purity and good process adaptability, and can meet the purity requirements of supercritical drying process and atmospheric drying process at the same time. At present, domestic and foreign enterprises using supercritical drying process basically use organic silicon sources. According to a report released by market research organization Markets and Markets, the global functional silane market will increase from US$1.33 billion in 2015 to US$1.7 billion in 2020, with an annual compound growth rate of about 5%. Among them, the strong demand for silane in the Asia-Pacific region is the main factor driving the growth of the global silane market. As the world's major silane consumer, China will lead the development of the silane market in the Asia-Pacific region. In addition, the silane market in other emerging economies such as Brazil and India will also gradually grow with the growth of their own economies. Global functional silanes are mainly used in rubber processing, adhesives, composite materials and other fields. On the supply side, the global functional silane production capacity in 2018 was about 596,000 tons/, and the output was about 415,000 tons. China is the largest production country, and its current production capacity accounts for 68.4% of the world's production capacity. Next are the United States, Japan and Germany, with production capacity accounting for 8.9%, 7.8% and 6.1% respectively, and the United Kingdom, Italy, South Korea, Belgium and Singapore, accounting for 2.0%, 1.9%, 1.1%, 0.8% and 0.5% respectively. Although the current production capacity in Southeast Asia is relatively small, there is a large room for growth in the future.

According to the annual report of Wacker in Germany, the per capita GDP level is basically proportional to the per capita consumption of silicone, and the growth of silicone demand in low-income countries is more elastic to income growth. In recent years, with the rapid economic growth, my country has become the world's largest producer, consumer and exporter of functional silanes.

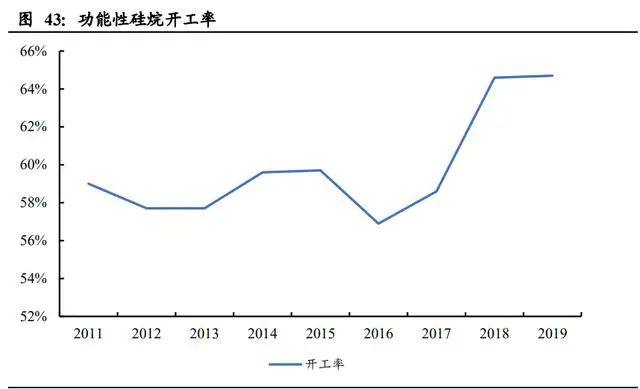

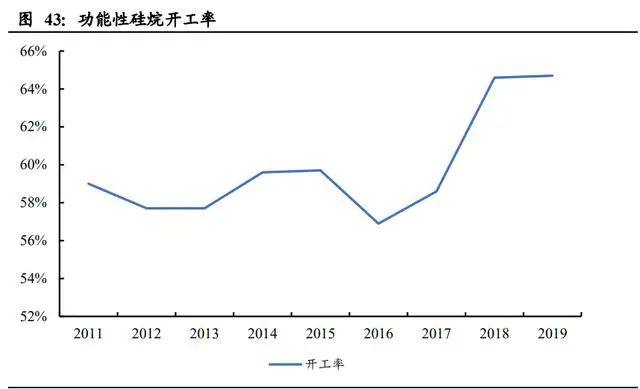

The price of functional silanes in my country is expected to decline. According to SAGSI statistics, from 2011 to 2019, my country's functional silane production capacity increased rapidly from 188,000 tons to 431,000 tons, and annual output also increased from 111,000 tons to 279,000 tons. Before 2017, due to the rapid expansion of production capacity, the combined influence of supply-side reform and environmental protection supervision, a large number of small and medium-sized enterprises were closed down, and the overall operating rate of the industry was not high. After that, the operating rate of my country's silane industry continued to improve, reaching 58.6% and 64.6% in 2017 and 2018 respectively. Since the beginning of 2019, major economies around the world have shown signs of slowing growth to varying degrees. The "anti-globalization" behavior represented by the Sino-US and European and American trade frictions and Brexit has further impacted the economies of countries around the world. With the slowdown in the growth rate of downstream demand and the continued improvement of the industry's supply capacity, the operating rate of my country's silane industry remained basically stable year-on-year in 2019. With the listing of functional silane manufacturers such as Chenguang New Materials and Hongbo New Materials in 2020 and the commissioning of projects such as Asia Tuo Chemical, my country's functional silane production capacity will increase by more than 160,000 tons. The further expansion of the supply-demand gap is expected to drive the average price level of functional silanes to fall, creating space for the cost reduction of aerogels.

Silane crosslinkers are gradually getting rid of import dependence. In terms of exports, my country's functional silane exports in 2019 fell slightly from 2018 to 91,400 tons. The main types of silanes exported by my country are sulfur-containing silanes, and the main export markets are the United States, India, South Korea, Japan and other countries or regions. The main types of silanes imported by my country are epoxy silanes and crosslinkers, mainly from the United States, Japan and South Korea. The main organic silicon sources of aerogels, such as TMOS, TEOS, and methyltrimethoxysilane, are all dealcohol-type crosslinkers, which is one of the main reasons for the high cost of organic silicon sources. With the substantial expansion of my country's future silane crosslinker production capacity, the organic silicon source of aerogel will gradually get rid of import dependence, and the cost-effectiveness brought by the increase in self-sufficiency will be more obvious.

From the perspective of market trends, with the growth and maturity of emerging market demands such as new energy vehicles, composite materials and surface treatment, and the fact that my country's per capita consumption of functional silanes is still lower than that of developed countries, my country's production and sales of functional silanes will continue to grow in the future, and the growth rate will remain stable. According to SAGSI estimates, by 2025, the total production capacity of functional silanes will reach 801,000 tons, the total output will reach 555,000 tons, and the consumption will reach 341,000 tons in the same period. The scale effect and the increase in the absolute difference between supply and demand will reduce the overall average price level of silanes.

From the perspective of product trends, after years of development, the variety, quality and output of functional silanes in my country have been greatly improved. With the rapid development of emerging industries such as solar energy, lithium batteries, LED lamps, and 5G networks, the demand for specific types of sealants and adhesives has become more and more differentiated. For example, in room temperature vulcanized silicone rubber, the demand for neutral glue has grown rapidly, making deketoxime glue the mainstream of the market, while acid glue is shrinking. In the future, the development of neutral glue will be the general trend. In addition, the development of high-end functional silanes in China is very rapid, and the technology of high-end silane products such as crosslinkers continues to break through. In the future, my country's functional silanes will develop in the direction of high-end, specialization and newness.

From the perspective of competition trends, the functional silane industry has undergone significant integration after explosive growth in recent years. Some small enterprises have gradually withdrawn, and the trend of production capacity concentration in large enterprises is relatively obvious. In 2020, the new production capacity of leading enterprises will be put into production one after another. The large-scale release of production capacity will have an impact on the supply and demand relationship of the functional silane industry. Moreover, most of the new production capacity is for silane types that still have a gap in the country. Filling this gap will improve the bargaining power of our products.

In the existing thermal insulation market, the cost of traditional thermal insulation materials is tens of yuan per square meter, while the cost of aerogel thermal insulation materials has dropped from more than 200 yuan per square meter two or three years ago to more than 100 yuan now due to the realization of large-scale production. However, there is still a gap between the current price of aerogel and the market acceptance. Once the production cost of aerogel materials is significantly reduced and the market price drops to a comparable level, the market scale will expand sharply.